This new strategy and online app is providing entrepreneurs, small business owners and working professionals with…

This new strategy and online app is providing entrepreneurs, small business owners and working professionals with…

Imagine if you could acquire a stake in a business without paying any money for it…

…and later buy 100% of the company funded entirely by its own operating capital.

Then, imagine selling the business for a large sum.

And imagine repeating this process again and again.

That’s exactly what my delegates and I have been doing to build generational wealth for ourselves.

It’s being done by people who are not seasoned entrepreneurs and many who have never bought a business before.

Plus, it’s been working during good economic times, bad economic times and even recessions.

In fact, whether you’re an employee looking to transition into a new line of work and become your own boss…

Or, you’re a business owner that wants to diversify into other markets, this unique strategy works equally well.

On this page, that you’ll discover how to acquire businesses without paying any capital upfront and the 5 factors that are now making this possible.

If you want to acquire profitable businesses (doing $1-10 million in revenue), this will be the most important letter you read.

Here’s why:

A perfect storm is brewing.

If you live in the US, UK, Europe, Australia, Canada, Singapore or New Zealand, pay close attention.

In each of these mature economies, five key factors are creating a unique opportunity to acquire businesses in 2024 without capital risk or using leverage.

Rather than start a business from scratch, you can acquire a profitable business someone else dedicated 10+ years to make successful.

Now, in a moment, I’ll share…

First, here’s the opportunity...

Consider these facts…

What does this all mean?

Baby boomers have immense time pressure to sell their businesses so they can enjoy their retirement.

Now, here’s what’s fascinating…

When you consider these five factors…

In fact, Forbes published an article calling this period “The Greatest Wealth Transfer In History.”

They expect around $30 trillion in wealth to be passed on to the next generations.

Plus, because the next generation (Gen X) is smaller, this wealth will be more concentrated.

Now, with all that said, here’s…

Many people think the easy way to acquire one of these businesses is to say…

And yes, while this IS a no-money deal structure, it’s not compelling.

If you use this approach you’ll likely get a hard “No!”

Baby boomers have no good reason to accept an offer like this.

They could accept a deal like this from a staff member or someone they trust.

The fastest and easiest way to acquire businesses without paying capital upfront is using a deal structure I called W.I.B.O (Work In, Buy Out).

I’ll explain exactly how this works in a moment.

First, it’s important you understand how this deal structure came about.

Back in the 90s, I started and grew a telecoms company in the UK from scratch.

It was a bootstrapped startup.

And, once we grew the business to £1 million, we started getting approached by other telecom companies who wanted to buy us.

See, at the time, telecommunications had become very fragmented. (i.e., lots of small players.)

It was going through a consolidation period where companies were frantically buying each other.

However…

The concept was totally alien to me.

Plus, I didn’t want to risk the capital.

And the cash flow in my business was always tight.

Anyway, as a result of our fast growth, a bunch of telecom companies contacted me offering to buy my business.

And I realized they all had one thing in common:

They pitched me deal structures that were appealing or solved my problems, but they were not willing to pony up a pile of cash on day one to get the transaction done.

I had a dawning realization:

If I don’t need a huge pile of cash to buy a company, maybe I should be the buyer, not the seller!

I approached different telecom owners and eventually found a business owner who was motivated and needed to exit.

To cut a long story short, I bought his business without any cash upfront or borrowing any money, and we…

Now, there’s no way I could have achieved this by any other means. (i.e., sales, marketing, or leveraging my team.)

This opened up an exciting new world of Mergers & Acquisitions for me.

Over the next 18 months, I bought 11 companies in total, grew my business 10 times bigger, and finally exited in 2006.

After that, I shifted my focus from starting businesses to buying and selling them full-time.

This completely transformed my life and wealth.

In 2009, I did lots of deals.

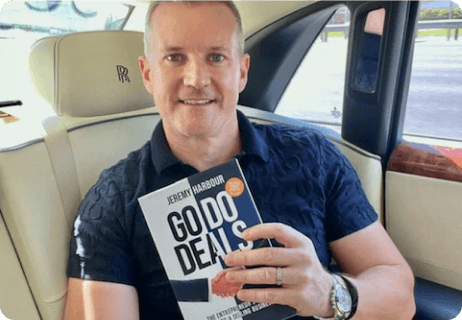

Jeremy has bought and sold over 100 companies, often exiting for 6-7 figures. He’s advised on more than 200 deals in various industries around the globe. Plus, he has taken three companies public on stock exchanges in New York, Frankfurt, and Paris.

As a result of my success, the media has featured him in publications such as Forbes, Entrepreneur, Money, Sunday Times, The Financial Times and more. He has also appeared on The Money Channel.

Recently, he wrote a book that became a Wall Street Bestseller called ‘Go Do Deals.’

Jeremy has been invited to Buckingham Palace and separately to The British Houses of Parliament to advise on business and enterprise matters.

Learn more about Jeremy’s professional background from Julius Baer, a private wealth bank based in Switzerland, who interviewed him for their ‘Change Makers’ series. You need a net worth of at least 10 million to open an account with the bank.

Jeremy has created most of his wealth from buying and selling businesses. Today, he’s blessed to live in a beautiful home, own a 100-foot superyacht, and private jet, and travel to exotic locations on a regular basis.

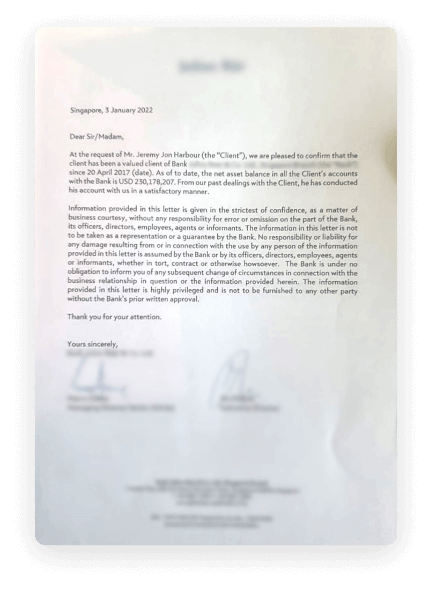

In Jan 2022, Jeremy requested a letter from his bank.

Keep in mind this is from just one of his accounts so it excludes assets like companies, houses, jets, cars, jewelry, stock brokerage accounts and other bank accounts. Click on the letter to see a larger version.

Note: The key points are blurred for privacy. If you become a client, you can see the full letter after you sign an NDA.

Letter from Jeremy’s private wealth bank showing his balance

(Click to enlarge)Amongst all the deals and success…

Amongst all these deals, I became known as ‘the guy buying companies without paying any cash upfront.’

As a result, I was constantly asked to do consulting or to sit on the board of various companies (as a non-exec) to help them acquire businesses with no cash upfront.

I didn't see the point.

Taking a salary didn’t make sense financially and if I found a company… I’d just buy it.

Then, shortly after, I bought a training company and realized that was the solution:

Offer a course so that everyone can learn these strategies.

So, in 2009 I launched the Harbour Club.

It’s a training course and community that has grown to 1,500+ dealmakers who now buy companies, share best practices and joint venture on deals.

Together, we’re constantly brainstorming and stress testing new ways to acquire businesses.

Anyway, what’s interesting is that of the 15 deal structures I teach…

It’s called W.I.B.O. (Work In, Buy Out).

Put simply, it’s a way to acquire a stake in a business with no prior relationship to a business owner and then buy the rest of the company from them.

It requires…

WARNING: With the wrong shareholders’ agreement this strategy won’t work. You’ll become a passenger in the business without any power to sell or make important decisions.

I’ll show you how to get the right agreement in a moment.

But first…

Over the years, delegates have joined our community and love all the various deal structures we teach.

Now, at this point, you’re probably wondering, “This sounds great, but will this strategy work for me?”

Don’t take it from me, here’s…

Over 1,500 delegates have joined our community and love the various deal structures we teach.

Harbour Club delegates share their thoughts on my 15 deal structures (including the W.I.B.O. strategy.)

Full Disclosure: This case study was recorded inside my other course and community, The Harbour Club, where I teach delegates the W.I.B.O. structure and 14 other strategies to acquire companies. You’ll hear me reference the community from time to time in the video.

“Jeremy’s strategies are incredible, I’ve done over 20 W.I.B.O deals with many more in the pipeline. If you want what I believe is ‘the best vehicle for personal wealth creation’, I strongly advise you to learn everything that you can from Jermey.”– John Kettley

See how many deals our delegates are closing using our deal structures (including W.I.B.O.)…

Full Disclosure: These clips were filmed at our live event DealFest – a different product of ours – where community members shared case studies about buying companies using W.I.B.O. (and other deal structures we teach.)

Now, because I noticed this W.I.B.O. strategy appeals to a slightly different audience than our regular Harbour Club community, I’ve decided to offer this as a separate course to a wider audience.

That’s why I’m happy to be…

How To Acquire Equity (And Even 100%) Of Profitable Companies Without Paying Cash From Your Own Pocket Or Borrowing Money

30-day money back guarantee

You’ll discover how to source qualified leads, negotiate the deal, secure a 10-25% equity stake, protect yourself, increase the company’s value, and how to exit (or acquire the rest of the company).

This course is available for you to view right away. It’s delivered 100% online.

Get access to a members group area where you can post any question you have about doing WIBO deals and I’ll personally answer all of them. You’ll be able to connect and chat with other group members too. No matter what challenge, problem or concern you encounter, you’ll get the help you need.

Note: This support is offered subject to our terms and conditions.

Valatoa

Getting a business owner to give you a stake of their company is no easy feat. That’s why my team created an online app that provides facts and figures to demonstrate the value you can bring.

Not only does Valatoa provide a business owner with a valuation estimate, it also points out the weaknesses that need to be improved to increase the valuation so you and the owner can exit for a higher price.

Note: This online app (Valatoa) is only available with the purchase of W.I.B.O. or as part of our Harbour Club community. You can not purchase it separately.

30-day money back guarantee

After inputting the data, Valatoa creates a custom 30-page report. This is incredibly valuable to business owners and a great hook to get conversations started.

Use the Analysis Reports to provide a convincing growth strategy, build the case for your proposed deal, and demonstrate the value you can bring post acquisition.

No more lengthy interview phone calls to pre-qualify the business owner. Valatoa reduces the pre-qualification time from 15 days to 30 minutes.

Inform colleagues of your report and have them spread the word to help you get more organic enquiries without spending money on advertising.

Business owners are surrounded by countless professionals, like accountants, brokers, financial advisors and lawyers. Valatoa’s custom valuation report helps you stand out.

Valatoa provides an independent valuation assessment to set a realistic expectation for owners of their company’s current value.

Leverage the professional reports to add credibility to your conversations with business owners.

Valatoa provides impartial and unbiased third-party data to estimate the value of the owner’s business.

Offer this business valuation and report to convert more leads into W.I.B.O deals where you take a stake in a business.

The online app is built from a unique algorithm that uses a combination of quantitative and qualitative methods, supported by data on more than 55,000 businesses. Valatoa pulls data from similar companies in the same industry and country to provide a fair and accurate valuation.

Watch this video to see how Valatoa helps you close more deals

Business owners complete a 20 minute questionnaire, filling in information on 10 key areas related to their business.

Normally, you need to ask owners dozens of questions over multiple phone calls to get answers. However, with our online app, you can pre-qualify leads in 15 to 30 minutes.

“A game changing valuing tool all M&A professionals should use”

“A game changing valuing tool all M&A professionals should use”

30-day money back guarantee

You’ll discover...

Step 1 – Source: What are the best types of companies to target using the WIBO strategy and how to find them

Step 2 – Discover: How to value a business accurately, get a price estimate and uncover improvements to increase its value using our in-house online app

Step 3 – Pitch: How to persuade owners to give you 10-25% equity in their companies without paying capital or borrowing money from banks

Step 4 – Close: How to draft agreements using the WIBO strategy and how to get the deal done

Step 5 – Improve: How you add value to a business so it's worth more

Step 6 – Exit: How to sell the business together with the owner (or how to buy the remaining shares without your own cash)

Step 7 – Wealth: (Optional) – How to increase the value of a business 3X to 6X to get an exponentially bigger exit

You’ll discover...

30-day money back guarantee

Inside this guide, you get dozens of tips, tactics and strategies from members of our dealmaker community who have each successfully closed at least one deal.

This new strategy and online app are helping entrepreneurs, small business owners, and working professionals with…

Now, with all that said, you’re probably wondering…

Let’s do a quick comparison: If you hired a deal team to do due diligence on a company before you bought it, you’d easily pay $10,000, $20,000 or more.

And there’s NO guarantee you’d buy the business either. In fact, I know someone who paid 20k to NOT buy a business.

On the other hand, this information is priceless.

You can learn a valuable skill (i.e., how to take equity and even buy entire companies without due diligence costs or paying cash), that you can use for a lifetime.

If you apply this knowledge and take action, this information could easily be worth millions to you.

So, you get the step-by-step course, online app to help close deals, sourcing templates, legal agreements, case studies, and unlimited ‘Ask Me Anything’ access, all for just $1,995.

This is an incredibly generous offer… especially considering that this costs less than hiring a lawyer to draft a sales and purchase agreement for one deal (which is not necessary with our templates.)

30-day money back guarantee

And to put your mind at ease, here’s…

Not everyone is cut out for doing deals. That’s why I’m offering this bold guarantee:

Go through the W.I.B.O. Course for 30 days. If you feel it’s not for you, email me at [email protected] within the 30 day period and my team will issue you a full refund on one condition:

You must set up a zoom call with me and share at least one suggestion on how I could improve the course. After the zoom call my team will promptly issue you a refund. No hard feelings.

NOTE: As you would expect, you will lose access to the Valatoa valuation app, the course login and support via questions if you request a refund.

The value included in this offer is very generous considering the small investment required.

Note: I may remove any part of this offer in the future. To guarantee you get everything mentioned above, take action today.

You have two options:

Option #1 – You could take the gist of what you’ve gathered on this page and try to figure out all the missing pieces on your own. It took me years and years to figure this out. If you have the time and money, go for it. Otherwise, the smartest option is…

Option #2 – Sign up right now and get my step-by-step course, templates and support to help you acquire businesses.

Remember…

A perfect storm is brewing.

Baby boomers are fast approaching retirement and need to exit their businesses.

Many of these businesses are not in a sellable state.

You can help business owners prepare their businesses for sale.

And as a result, you can acquire a stake (or even the entire company) without leverage or paying money from your own pocket.

Now is the perfect time for serious business owners and working professionals to build wealth for themselves and their families.

Sign up now and use the most exciting strategy to build generational wealth in 2024.

30-day money back guarantee

Regards,

Jeremy Harbour

P.S. I’ve been doing M&A deals all the way through the last recession, and this absolutely works during a bad economy.

Yes. This W.I.B.O. strategy has been used to take stakes (or buy out entire companies) all over the world. Countries like the UK, USA, Canada, Australia, New Zealand, Singapore, and lots of countries in Europe.

After checkout, you’ll receive email instructions with details to access the content. You should get this within five minutes of the order. Everything is ready to view right away.

No, you don’t need any special skills. In fact, as part of the course you get to use our online Valatoa app, which does a lot of the consulting for you. Rather than figuring out what the business needs to become a sellable asset – so you and the owner can exit for an attractive price – the tool pinpoints the business’ strengths and weaknesses for you. The only thing you need is the ability to empathise with business owners as the strategy I teach in this course is rapport-based. You get to generate 50 reports for free included in the cost of the course.

No. There are millions of businesses you can buy. In the U.S. alone, approximately 10,000 baby boomers are retiring each day and all of them will need to transition out of their businesses. In fact, last time I checked, there were 63.9 million small to medium-sized businesses when you combine all the english-speaking countries (plus Europe). And because baby boomers own a very large portion of these, there’s a massive oversupply. Plus, the next generation (Gen X) is smaller so there are less natural buyers. That’s why – with the right pitch and agreement – you can take over these businesses without paying any cash from your own pocket.

It’s simple. Here’s my video response answer:

I’m sector agnostic. Over the years I’ve bought all sorts of businesses (over 100 in total now.)

Some examples are a 15,000 square foot health club and spa, which was built and fitted out 5 years previously for over £3m (with about 1000 members paying £40 a month), a 33 year old air conditioning company with local government contracts, a software developer company with customers like GM and Philip Morris and a 20 year old PR company with £1m of revenue.

You get to learn a proven strategy to buy stakes in companies (and even 100% of them) without investing cash, without borrowing money and without due diligence costs.

The offer includes…

Plus, you’re covered by our 100% money-back guarantee.

You have nothing to lose and everything to gain.

30-day money back guarantee